Solana and the SOL token

Solana is a blockchain platform built for distributed hosting. And scalable applications. An open-source project founded in 2017 and operated by the Geneva-based Solana Foundation, San Francisco-based Solana Labs developed the blockchain. The lead developers behind the creation of Solana are Anatoly Yakovenko and Raj Gokal, both working in Solana Labs.

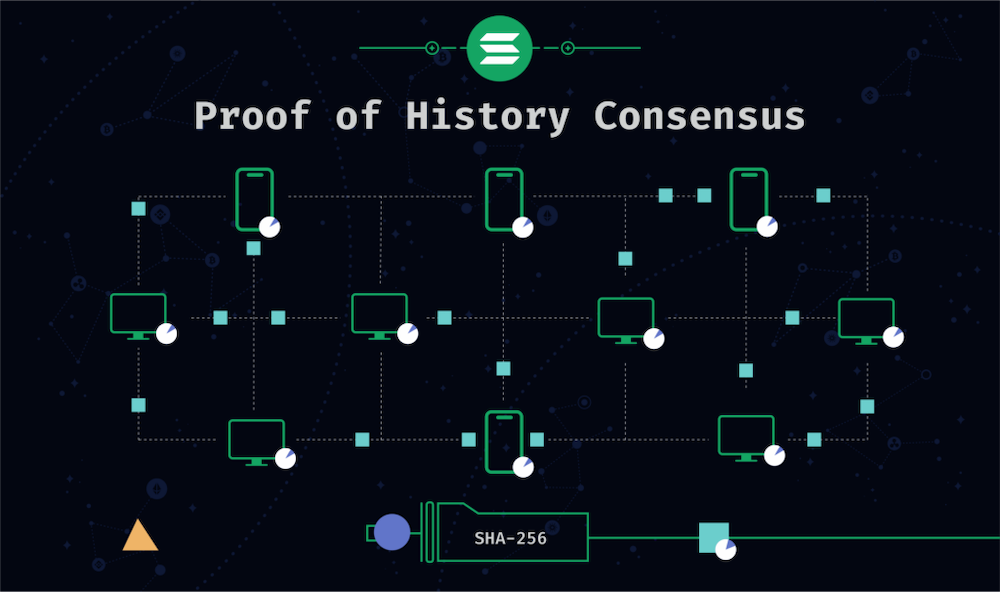

Solana is a Proof-of-Stake (PoS) blockchain using a new technology called Proof of History (PoH). Unlike Proof of Work, which uses miners to determine the next block in the chain, or Proof of Stake, which uses staked tokens to select the next block, Proof of History uses timestamps in Its block definition for the Solana chain. This innovative system allows blockchain validators to vote on the timestamps of on-chain blocks. This keeps the chain relatively decentralized while allowing faster and more secure computation. Solana ensures composability between ecosystem projects by maintaining a single global state as the network scales. The blockchain do not need to deal with fragmented Layer 2 systems or sharded chains.

Using a unique combination of historical proof and delegated proof of stake, Solana delivers exponentially faster transaction speeds than its closest competitors, Ethereum (ETH) and Cardano (ADA), for a fraction of the cost. Solana is much quicker in phrases of the variety of transactions it can handle and has significantly lower transaction fees.

The cryptocurrency running on the Solana blockchain uses the ticker symbol “SOL”. SOL token is available in a split called Lamport. The value of Lamport is 0.000000001 SOL. Lamport is named after one of Solana’s most critical technical influences, Leslie Lamport, a computer scientist best known for his work on distributed systems.

The Solana Foundation has announced that there will be a total of 489 million SOL tokens in circulation, of which 260 million have already entered the market.

The most popular storage for SOL tokens is in Phantom wallet, which is easily available for download as long as internet connection is available. Another popular SOL token wallet is SolFlare, which is comparatively more difficult to use than Phantom wallet but has been around for much longer time. Sollet is another popular SOL token wallet, though the developers are encouraging less technical savvy users to switch to other wallets and let the professionals use Sollet. SOL token can also be stored in a cold wallet like Ledger.

The SOL tokens can be staked and used as collateral to settle transactions on the network. These transactions include validating smart contracts using Solana as a marketplace for non-fungible tokens (NFTs). One of Solana’s significant breakthroughs happened in August 2021, over a year after Solana’s launch. At this time, Degenerate Ape Academy became the first major NFT project on Solana’s NFT Marketplace. In the first three weeks of that month, Solana’s price has gone up from about $30 to $75. Solana’s all-time high reached November 2021, when it peaked near $260 at the height of the crypto bull run.

Overall, SOL rose nearly 12,000% in 2021, reaching over $66 billion in market cap, becoming the 5th largest cryptocurrency in the World. Since September 11, 2022, SOL’s market capitalization has dropped to approximately $12.4 billion. It also declined to 9th place by market capitalization.

How Does Solana’s Proof of History Work?

Solana works on a combination of historical proof-of-stake and proxy-proof protocols.

Because of the combination of these protocols, Bryan Routledge, an associate professor of finance at Carnegie Mellon University’s Tepper School of Business, explains that Solana is trying to “process a lot of transactions quickly.”

Routledge points out that they are trying to process transactions quickly, and this process often requires concentration. For example, Visa uses a mainframe network to maintain processing speed. On the other hand, Bitcoin processes transactions very slowly in order to maintain decentralization and security.

The whole point of blockchain technology is to provide a decentralized and secure systems. However, a system that is decentralized and secure will likely become unscalable or high cost. Solana strives to process transactions at speeds close to that of a large, centralized company like Visa while remaining relatively decentralized. Some level of decentralization is sacrificed, while security is maintained and scalability is achieved.

Solana v.s. Ethereum

Solana’s rapidly growing ecosystem and diversity have inevitably led to comparisons to Ethereum, the leading blockchain for decentralized applications (dApps).

Solana and Ethereum have essential intelligent contract capabilities for cutting-edge power applications such as decentralized finance (DeFi) and non-fungible tokens (NFTs). However, there are a few crucial variations between the two. Ethereum was a proof of work blockchain which recently switched to proof of stake. Ethereum tries to maintain the decentralization and security like Bitcoin, by doing so Ethereum is not able to achieve the scalability that Solana has already managed to achieve.

Much of the excitement surrounding Solana in 2021 was due to his clear edge over Ethereum regarding transaction processing speed and transaction costs. Solana can manage as much as 50,000 TPS with an average price per transaction of $0.00025. In contrast, Ethereum can only process less than 15 TPS, but transaction fees have reached $70 in 2021. However, Ethereum still has the first-mover advantage, with its large ecosystem of much more developers building on it than any other blockchain, making Ethereum second only to Bitcoin in market capitalization.

Investing in Solana

Suppose you want to speculate about Solana or some other cryptocurrency. If so, you can trade them directly or invest in companies that may benefit from growing interest in the industry.

Like most significant cryptocurrencies, SOL tokens can be traded on any platform. These include centralized exchanges such as Binance.US, Coinbase and Kraken. In some cities across the globe, SOL tokens are even available at crypto ATMs and NFTs.

SOL tokens also have many use cases. Among different things, they may be used for peer-to-peer payments and transactions and as an incentive to secure the Solana network as a validator. But as with all cryptocurrencies, investors should consider talking with a financial advisor before investing in Solana. Cryptocurrencies are highly volatile and dangerous investment vehicles. Investors need to be sure they can afford to lose the money they invest in SOL, even if they believe in Solana’s potential.