Money / Payments

The First cryptocurrencies were created for the purpose of a payment instrument (currency).

Blockchain-based solutions improve how we send money to and from each other. It does this by enabling new and innovative ways to create an irreversible ledger of sensitive data and transactions securely and efficiently. These features make blockchain-based or blockchain-inspired solutions excellent for international payments and money transfers.

Today, any person who has access to the internet can send huge sums of money to someone completely without a third party via a cryptocurrency blockchain. This process previously involved several third parties, like the banks and money changers, and was often associated with high costs. In many cases, blockchain is a key enabling technology, a new solutions for how value is being transferred between people, corporations, and machines.

Another example is the growing interest from central banks around the world in adopting the technology or at least adopting new technology which is built on several of the features found in blockchains. According to the Bank of International Settlements (BIS), over 70% of central banks are looking at issuing a digital currency on a blockchain.

There are multiple examples of cryptocurrencies being adopted in the traditional financial institutions as a mode of payment. On September 9th, 2020, Mastercard announced its launch of a Central Bank Digital Currencies platform. In 2018, Banco Santander launched the world’s first blockchain based money transfer service through the use of Ripples solutions. Swedish Bank, SEB, has also been exploring the use of Ripples blockchain-based solutions for some years.

All of these solutions and many more that are not mentioned in this text are creating new solutions for how value is being transferred between people and people, corporations and corporations, people and corporations and also machines to machines and people to machines. In many of these cases, blockchain is found to be an enabling key technology.

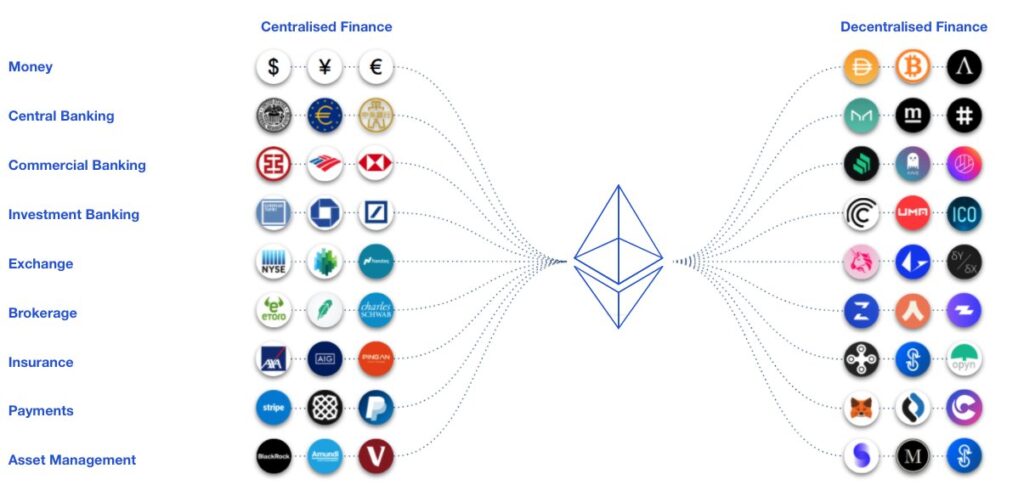

Decentralized Finance (DEFI)

Decentralized Finance, or DeFi, is a class of blockchain technology applications that aims to create decentralized versions of traditional financial instruments.

Lending is an example of a DeFi use case. DeFi Lending apps can connect borrowers directly with lenders, mitigating the need for an intermediary. The lender and the borrower are bound to each other via a smart contract which is responsible for:

• The correct distribution of the interest generated.

• Dictate the whole loan agreement based on predefined conditions.

This open and public nature of DeFi lending can be beneficial for both the borrower and the lender.

Insurance

In the insurance industry, blockchain technology enables for improvements for efficiency, cost savings, time to payout, transparency, and fraud mitigation. Blockchain enables data to be shared in real-time between different parties involved in the insurance industry which is something the industry is missing today, and tedious for companies and agents to confirm about insurance claims.

One area that is growing in interest is the use of Smart Contracts for business process automation. For example, through the use of the Ethereum Enterprise Alliance blockchain and the Baseline Protocol, insurance companies could create a trusted, tamper-proof, industrywide record of claims.

Anti Money Laundering / Fraud Prevention

Blockchain technology has had increased attention in the financial services industry for a number of reasons. One of these areas is to make Fraud Prevention and Anti Money Laundering (AML) better and more efficient.

Blockchain technology could for example be used in more efficient sanctions and AML enforcement contexts. For instance, the balance between keeping transactions private or to support more traceability is a debated topic. Here, the technology could allow for the implementation of KYC/AML procedures based on the size of a transaction. This would allow for keeping transactions with high value transparent and transactions of the low value private or anonymous. A feature that is investigated by many central banks around the world today.

Logistics and Trade Finance

Over the years, blockchain’s use in supply chain management has increased across many sectors. Blockchains are improving quality throughout the supply chain while saving unnecessary costs for businesses and consumers. It is creating a colossal network effect which directly connects the interests of consumers to those of businesses via the blockchain.

An example of blockchain’s use is in Coca Cola’s tech partner, Coke One North America. The company implemented blockchain solutions in 2019, based on the Hyperledger Fabric blockchain. Another example is OriginTrail which is an ecosystem committed to improve interoperability and connectivity between supply chain networks. It is often called ‘The Google of Supply Chains’. ‘OriginTrail’ protocol is a trusted data exchange used across many sectors, including food production, fashion, agriculture, pharmaceuticals, compliance, and finance.

Governments

Blockchain-based solutions have enormous potential to be used in the government sector. There are multiple areas whereby blockchains can improve people’s data protection, streamline how processes involving government are carried out and prevent fraudulent and abusive use of government services.

Furthermore, blockchain can potentially reduce the amount of human labor in government processes. It is also a viable solution to prevent corruption because of increased transparency. There are many other use cases ranging from digital voting systems, identity management systems and, legal entities management that can benefit from the use of blockchain technology.

Most governments in well-developed countries have begun experimenting with blockchain in one way or another. The government of Canada is one example of a government that has been exploring with the use of public blockchain Ethereum for handling government contracts to increase the transparency. and reliability of sharing public data. In Europe, the EU Blockchain Observatory & Forum have accelerated their research in blockchain and another interesting project is the upcoming introduction and launch of the European Blockchain Services Infrastructure (EBSI).

Identity

Identity is one of the more interesting use cases of blockchain technologies, and very much in line with how government sectors can benefit from this new technology. By digitizing identities and the use of blockchain, we can massively improve what is included in identity and how people around the world can access their digital identities.

According to the United Nation Convention on the Rights of the Child, Article 8, the most basic identity must consist of the following data:

• Full name.

• DOB (date of birth).

• Nationality.

• A national identifier (social security, driver’s license, etc.)

Identities with the above properties around the world are in most cases not digital. Furthermore, approximately 1.1 billion people around the World do not even have a valid proof of identity and are often among the poorest people in the world. Blockchain technology allows for the creation and management of digital identities through the use of the following components

• Identity Management

• Embedded Encryption

• Decentralized identifiers (DIDs)

One example that uses the above components is IBM’s Self Sovereign Identity solution Pulse which enables for lifetime portable identity for any person, organization, or thing that does not depend on any centralized authority and can never be taken away.

Real Estate

The Real Estate industry is one of the largest, if not the largest, asset class in the world. The total global value is worth hundreds of trillions of dollars, with residential property making up a vast majority of it. This industry opportunities for improvements that could benefit from the use of blockchain technology, especially in the area of identifying the owner (owners) of a real estate.

Using Non Fungible Tokens (NFT) to do tokenisation of real estate assets can improve the management processes around real estate and not the least when it comes to buying and selling properties in a digital way. Tokenization also opens up for fractal ownership. Meaning that instead of owning a whole building, an individual can own a percentage of the building or a land plot. This would likely reduces barriers to entry to the real estate market drastically.

Healthcare

During 2020, there have been several suggestions on blockchain based-solutions for data sharing of COVID19 test results, one of many projects is MiPasa platform that uses Hyperledger Fabric.

Non-profit organisation Canadian Blood Services is working on a proof-of-concept to track blood donations in real-time which would streamline the processes around blood sharing enourmously.

There are many many more examples around the world whereby blockchain is utilized to facilitate the healthcare sector

Others …

The use of cryptocurrencies and blockchain technologies are not just limited to the few items listed above. There are many more industries adopting cryptocurrencies or blockchain as a technological solution. More ways to use cryptocurrencies and blockchains are also discovered regularly , and I am sure that in future we will have many more industries adopting this new solutions.