Altcoin season refers to a period where non-bitcoin cryptocurrencies, known as altcoins, outperform BTC.

During an altcoin season, altcoins tend to outperform Bitcoin, causing Bitcoin to lose dominance in the crypto market. Because of this, seasoned traders and investors with diversified portfolios take note of altcoin seasons to adjust their portfolios accordingly.

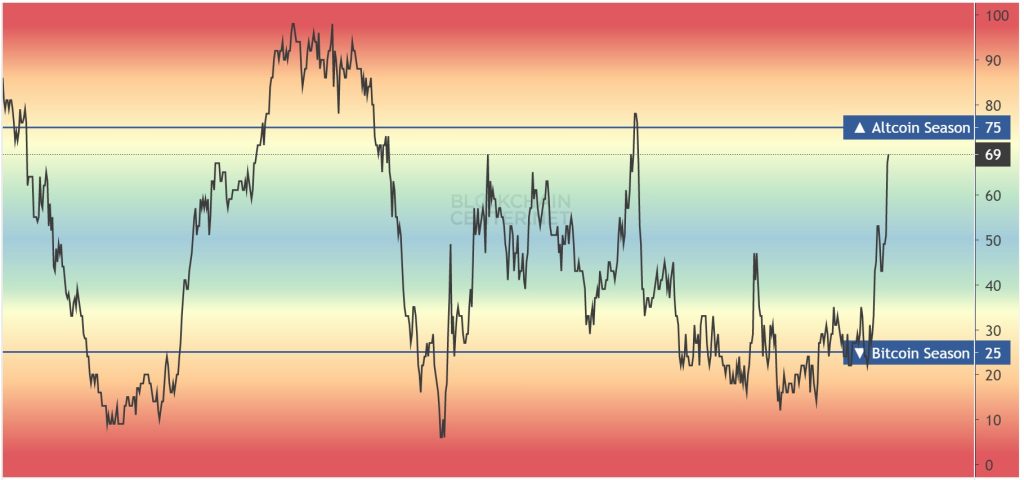

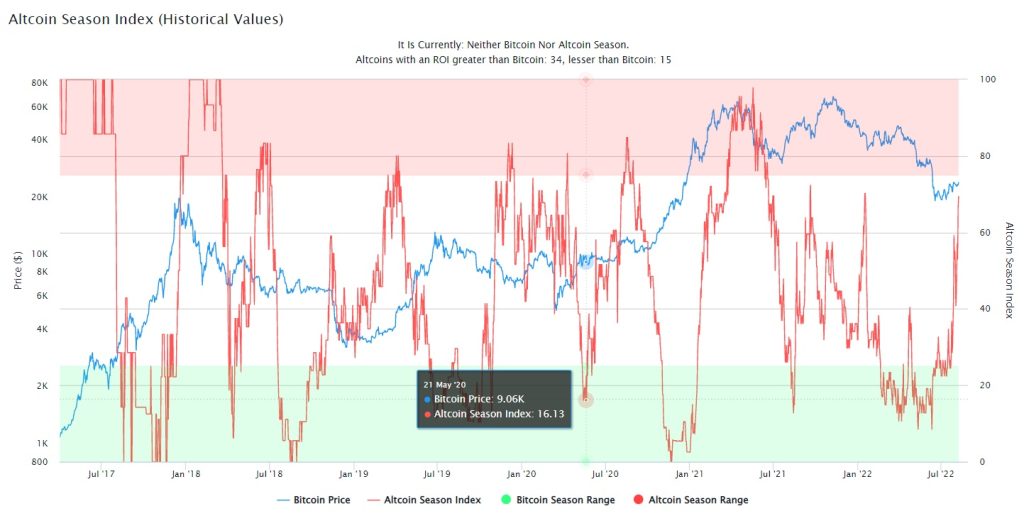

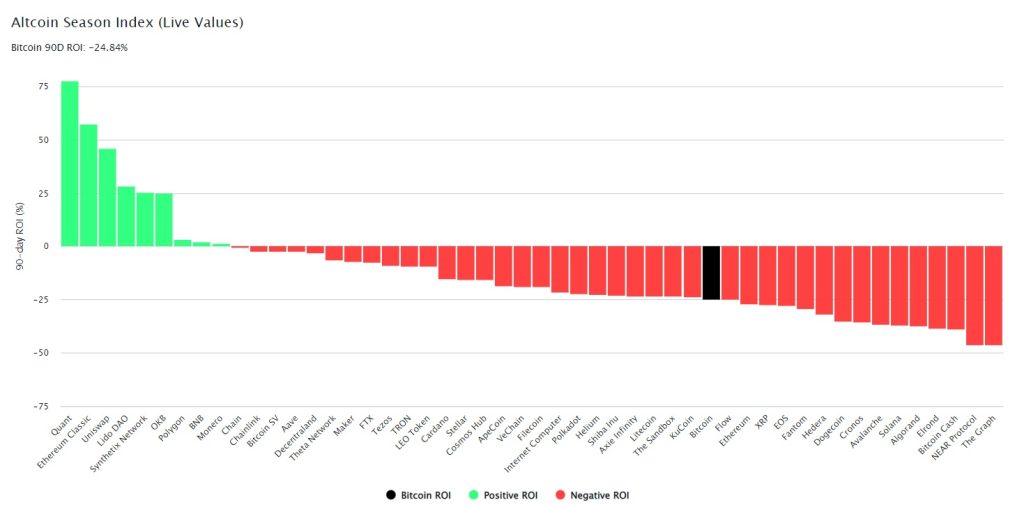

The Altcoin Season Index is defined as the amount of top 50 altcoins that have a 90-day return of investment (ROI) greater than Bitcoin, divided by the amount of top 50 altcoins that have a 90-day return of investment (ROI) lower than Bitcoin. Whenever less than 25% of altcoins have a 90-day ROI greater than BTC, we say that it is ’Bitcoin season’, because then Bitcoin is outperforming most altcoins. Likewise if more than 75% of altcoins have a 90-day ROI greater than Bitcoin, then most altcoins are out-performing Bitcoin and we call it ’Altcoin season’.

There are several ways that we can find Altcoin Season Index displayed in various websites. The following are 2 examples.

If 75% of the Top 50 coins performed better than Bitcoin over the last season (90 days) it is Altcoin Season. Excluded from the Top 50 are Stablecoins (Tether, DAI, USDC …) and asset backed tokens (WBTC, stETH, cLINK,…)

Please take note that the Altcoin Season Index is simply a trading tool for reference. It is not 100% accurate. The measurements depends heavily on the top 50 altcoins (excluding stable coins), which itself changes over time. It is useful for an investor to make decision on the percentage holdings of bitcoins and altcoins on his/her portfolio.

For the readers who are keen to check out an Altcoin Season Index, it is available on this link: https://www.blockchaincenter.net/altcoin-season-index/