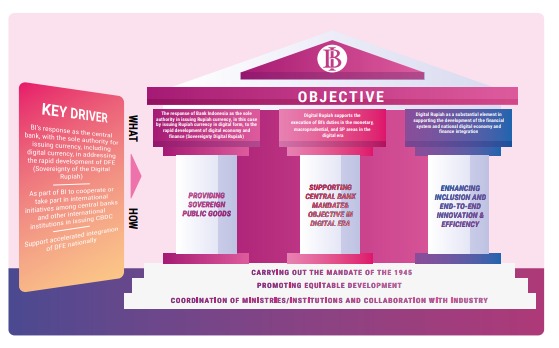

In an era defined by rapid technological advancements and digital transformation, nations are increasingly exploring innovative avenues to ensure the continuity of their economic sovereignty. Indonesia, a dynamic and forward-looking nation, has embarked on a pioneering journey with its Central Bank Digital Currency (CBDC) initiative, affectionately known as the “Digital Rupiah.” This initiative, under the banner of Project Garuda, represents a significant stride towards safeguarding the country’s monetary autonomy in the digital age.

Project Garuda stands as a beacon of Indonesia’s commitment to embracing digital evolution while retaining control over its currency. The Digital Rupiah is a testament to Bank Indonesia’s vision, encapsulating the spirit of innovation and financial inclusivity. By aligning with the Blueprint Sistem Pembayaran Indonesia 2025 (BSPI 2025) and Blueprint Pengembangan Pasar Uang 2025 (BPPU 2025), the project underscores Bank Indonesia’s dedication to national digital transformation and the seamless integration of digital economy and finance.

The foundation of this revolutionary endeavor was laid with the release of the Digital Rupiah White Paper on November 30, 2022. This comprehensive document not only outlines the high-level design of the Digital Rupiah but also serves as a bridge of communication between Bank Indonesia and the public. The White Paper delves into the intricacies of the Digital Rupiah’s integrated design configuration, its potential to stimulate new business models, the underlying technological architecture, and the regulatory framework that supports its realization.

Taking the initiative further, Bank Indonesia published the Consultative Paper titled “Project Garuda: Wholesale Rupiah Digital Cash Ledger” on January 31, 2023. This paper marks the next step in the CBDC journey, seeking insights from a wide array of stakeholders, including both public and private entities. It articulates the immediate phase of Rupiah Digital’s development, with a focus on wholesale Rupiah Digital cash ledgers and their foundational functions such as issuance, destruction, and fund transfers. Importantly, the Consultative Paper addresses potential impacts on the payment ecosystem, financial stability, and monetary policy.

The Digital Rupiah is more than a technological innovation; it embodies a collaborative approach to maintaining economic resilience. Indonesia’s engagement with global central bank communities and international organizations underscores the commitment to harmonizing the Digital Rupiah’s design with global standards. Interoperability across borders and seamless cross-country transactions are among the goals that underscore the consultative approach taken by Bank Indonesia.

Indonesia’s journey towards a sovereign Central Bank Digital Currency, epitomized by the Digital Rupiah, is a testament to the nation’s vision and determination. As technology reshapes the contours of economies and financial systems, the Digital Rupiah emerges as a symbol of Indonesia’s readiness to embrace change while upholding its monetary independence. The roadmap set by the White Paper and the collaborative insights from the Consultative Paper serve as guiding lights, illuminating a path toward a digital future where the Digital Rupiah takes center stage on the global financial landscape.